Plan Your Gift

Pooled Income Funds

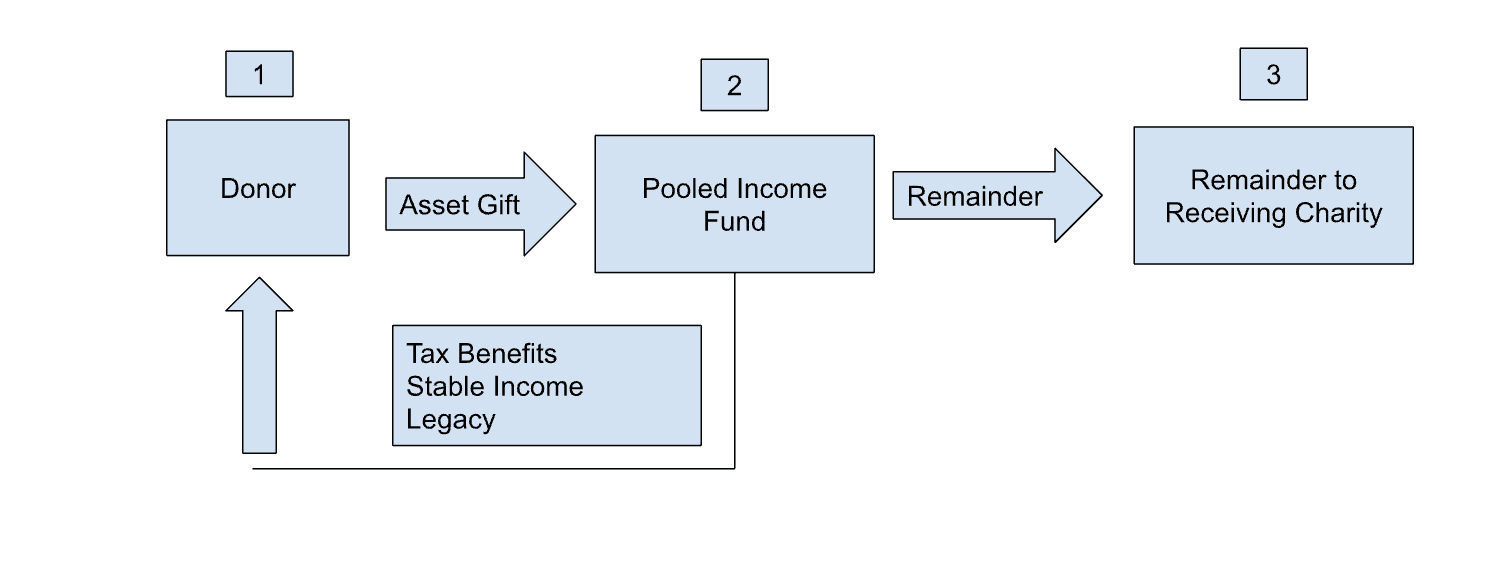

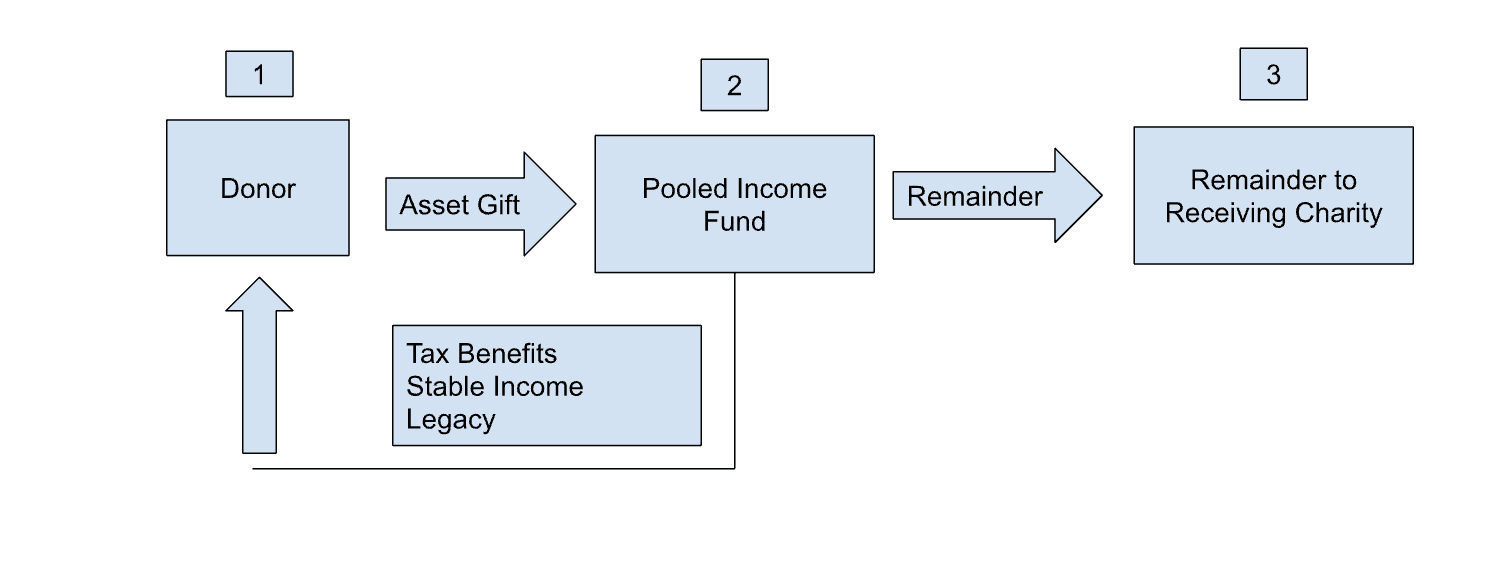

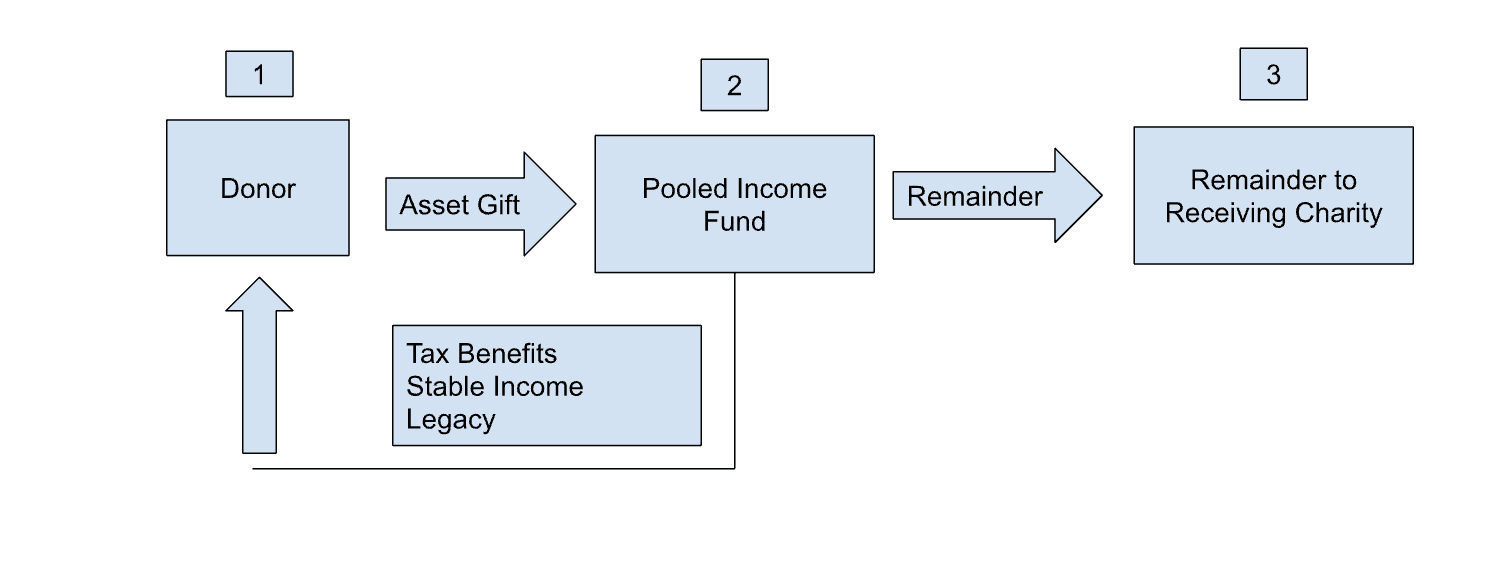

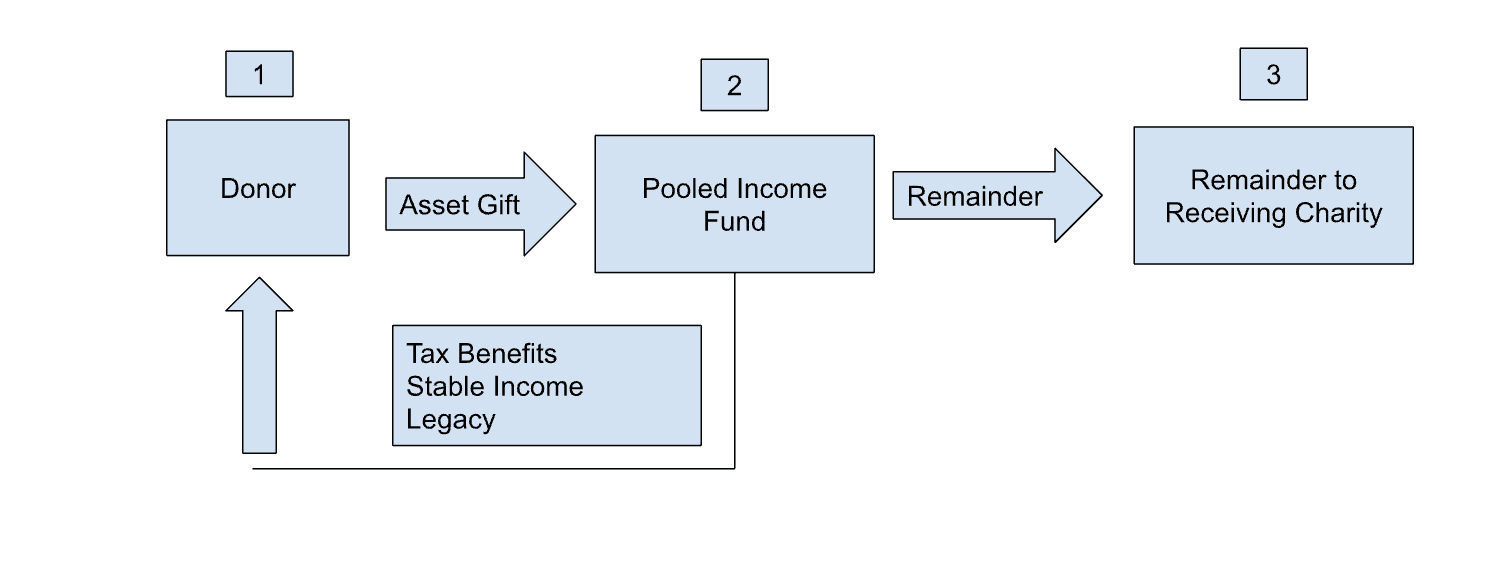

By contributing to a pooled income fund, you support yourself and benefit Closehaul Capital Charitable. Your donation acquires shares in an investment collective, similar to a mutual fund.

Every year, the fund's income is distributed among the participants of the pooled income fund based on the number of shares they possess. You can designate yourself and/or other beneficiaries to receive the income generated from these shares for their lifetime. Once the income beneficiary passes away, the shares are repurposed to benefit the organization as you specify.

By contributing to a pooled income fund, you support yourself and benefit Closehaul Capital Charitable. Your donation acquires shares in an investment collective, similar to a mutual fund.

Every year, the fund's income is distributed among the participants of the pooled income fund based on the number of shares they possess. You can designate yourself and/or other beneficiaries to receive the income generated from these shares for their lifetime. Once the income beneficiary passes away, the shares are repurposed to benefit the organization as you specify.

Benefits

1- Annual Income

2- Investment Diversification

3- Federal Tax Deduction

4- Possible State Tax deductions

5- No immediate capital gains tax appreciated assets transfers

6- Make a Gift to a good cause.

Benefits

1- Annual Income

2- Investment Diversification

3- Federal Tax Deduction

4- Possible State Tax deductions

5- No immediate capital gains tax appreciated assets transfers

6- Make a Gift to a good cause.